VA Home Loans and Their Requirements

VA Loans in Greenwood Village are types of mortgage loans that are backed by the United States Department of Veterans Affairs. This means that the lender is a veteran and can be sure that their money will be in good hands. The VA guarantees the loan amount, which means that you do not have to pay a dime in interest. For this reason, you do not have to worry about the lender’s financial stability because the VA will take care of the loan.

Depending on your credit, you can finance 100% of the purchase price. While there is no down payment requirement, you will need to provide a down payment equal to or more than the appraised value of your home. If you cannot make a down payment, you can use a special housing adaptation grant to purchase a home for yourself or a family member.

VA loans are among the lowest rates available in the mortgage market. At the end of Q3, the average rate for a conventional loan was 4.27%, and this is the lowest rate for a mortgage that the Department of Veterans Affairs offers.

If you are unable to make a down payment, you can apply for a second loan. You can also apply more than once for a VA loan. There is no prepayment penalty, and you can use it multiple times for the same mortgage.

Your credit score is a significant factor in the approval process, and you must prove that you are financially and otherwise eligible for one. It is advisable to hire an agent knowledgeable about VA loans and who understands how the process works. You can also get pre-approval letters from online sources.

Who is Eligible For a VA Loan in Greenwood Village?

One of the first requirements to qualify for a VA loan in Greenwood Village is that you must be a Veteran. The VA requires applicants to prove that they are eligible for the program. Income and assets must be verified, and the Veterans must show they can afford the loan. It is essential to provide documentation to show that you are eligible to qualify for a VA loan. Also, lenders will run a credit check to determine whether you qualify for the program.

![VA Loans Greenwood Village Colorado]()

While most lenders will require a FICO score of 620, the VA does not have a minimum requirement. However, if you are a veteran, you must have a credit score of at least 580. A qualifying mortgage will require that you pay a funding fee of 2.3% of the loan amount, which can be rolled into the loan balance.

The final requirement is to prove that you have made payments on all of your debts. Regardless of when you served, your income and credit history must be solid. Moreover, you must meet the income and borrowing requirements. The VA does not grant a loan to people with credit histories that fall below these requirements. The spouse or widow of a deceased service member can also get the loan.

During the period between 1947 and 1964, you must have completed 90 days of active duty. If you served during wartime, you must have served for at least 90 days during a conflict. During peacetime, you must be at least 57 years old. During this time, you can regain eligibility for a VA loan. If you have served during wartime, you need to have at least 181 days of continuous service.

To apply for a VA loan, you must be a veteran. To qualify for a VA loan, you must be active duty or National Guard member. It would be best if you also had a good credit rating to be eligible for a VA loan. Once you have a Certificate of Eligibility, you can apply for a loan. If you have been in the military, you will be eligible for a VA loan.

Greenwood Village VA Loans – Who Can Apply For a Certificate of Eligibility?

![what are VA loans?]() Most mortgage lenders in Greenwood Village will prepare a form for you to fill out and send to the Regional Loan Center. You can post the completed form to the Regional Loan Center to get your Certificate of Eligibility. The regional office will send your request for the COE to the appropriate department. You can also submit your application by mail to the VA loan center.

Most mortgage lenders in Greenwood Village will prepare a form for you to fill out and send to the Regional Loan Center. You can post the completed form to the Regional Loan Center to get your Certificate of Eligibility. The regional office will send your request for the COE to the appropriate department. You can also submit your application by mail to the VA loan center.

First, you should gather all your documents. If you have a discharge paper, you need to attach it to the application. Then, if you are a member of the National Guard or Reserves, you must provide the statement of service listing the years of creditable service. If you have any questions or need more information, you can always contact the loan officer.

You should check with the lender whether they offer this service. There are many benefits to completing this online form, but it does have some drawbacks. You should make sure the lender has access to this system before submitting your application. This system will take a few minutes to process, and it will be issued within a few days. However, if your case is inactive, you will need to submit another form for a new COE.

Generally, you need to present a Certificate of Eligibility from the Department of Justice to qualify for a VA loan. You must also submit proof of your service, including an original statement of service that shows the dates of your active duty and any military awards. This document is necessary to prove that you are eligible for a VA loan. This document will be given to the lender. You will need to show it to the VA if you are still serving in the military.

The VA COE is a document that will allow the VA to determine your eligibility for a VA home loan. It should be in the form of a letter and should include the county’s name in which you are planning to purchase a home. You should read the certificate carefully, and you should not sign it until you have received your COE. You can request a copy on the VA website. There is no fee to obtain a Certificate of Eligibility from the VA, and you can apply for one without any hassle.

Once you have obtained your COE, you should consult your VA lender. The VA is required to issue a COE to all qualified veterans. Your employer should have the right to sell any property you purchased with a VA loan. In addition, you should discuss your eligibility code with your lender and discuss your options. Your COE should be current and accurate. To obtain a COE, you should have the DD-214 and good separation papers.

Once your COE has been processed, you should follow up with your local VA office. If you have not received your COE yet, you should be in touch with your VA office. If you were not discharged honorably, you must request the certification. Your COE will be issued as soon as you have paid the application fee. Ensure that you have it on hand before the application deadline.

Once you have found a VA-approved lender, you need to complete the VA Form 26-1817. You can also send the form to the regional VA office in your area. The lender requires these forms. If you have a copy of your COE, you must send it to the VA. The COE is essential in getting a loan, and you may need it if you want to borrow money for your family.

Is It Difficult To Get a VA Loan in Greenwood Village?

The down payment is a significant barrier for many people in getting a VA loan in Greenwood Village. Unfortunately, the down payment is often the worst part of the process. Whether it is a lack of funds for the down payment or a high amount of debt, it is never pleasant to receive bad news. Thankfully, the VA program can be easily avoided, which is why many borrowers have turned to it as their primary source of financing.

To obtain a VA loan, you need to be a veteran or a surviving spouse of a veteran. You need to provide a separation report (DD214) and a statement of service (Statement of Service). Your credit score may also be required. Lenders may have different minimums, but the VA does not set a specific minimum. It is recommended to check with several lenders to see what their requirements are.

Another aspect of a VA loan is its negative equity position. This is temporary in a rising market. While the negative equity position is only a temporary inconvenience, it can lead to significant problems. Aside from the negative equity position, the help of VA loans is that they require no money down. Furthermore, they are usually easier to qualify for than conventional loans. This means that you have a significant advantage over non-veterans.

VA loans are not any more challenging to get than conventional mortgages. There are some exceptions, in any case. The maximum you can qualify for is $417,500, and the maximum amount that you can borrow is still dependent on the value of your home. In addition to the waiting period, the loan can be more expensive than a conventional mortgage. Nevertheless, if you have been a veteran, VA loans may be the best option for you.

The government’s guarantee is an excellent help for those who have been denied a conventional mortgage. The government will cover up to $510k, but there is no guarantee that you will never fall behind on payments. The down payment is only 3.5%, and VA guidelines require that borrowers have a stable job and good credit. While these limits may seem daunting, they can make it easier to qualify for a VA home loan. This is a massive benefit for many borrowers, and it will save you money and time in the long run.

Greenwood Village Benefits of a VA Loan?

Veterans can take advantage of Greenwood Village VA Loan benefits more than once. This program limits closing costs and allows veterans to use the money saved on a variety of expenses. This program is beneficial for those with disabilities. The benefit can be used for building or remodeling a home. In addition, it can be used to purchase furniture and other items that would not otherwise be affordable. In addition, it eliminates the need to pay monthly mortgage insurance. However, it is essential to remember that there are specific requirements and restrictions.

First, the VA Loan benefit can only be used once. You must meet service requirements to receive the loan. In addition, you cannot use the honor more than once. If you’ve served in the military or a government agency, you can get a VA Loan. The gift can be used time again. Lastly, the loan doesn’t have any down payment requirements. You can even hold multiple VA loans at once.

Pre-qualifying for a VA loan can save you time and energy in the future. It involves a candid conversation about your finances and other personal factors. While pre-qualification does not guarantee you’ll qualify for a VA loan, it will save you from surprises later in the process. By doing so, you can avoid any pitfalls during the underwriting process. This will save you time and money. After all, you’re trying to buy a home.

Another advantage of applying for VA loans is that it requires no private mortgage insurance. The VA Loan is easier to qualify for than any other type of loan. You can also use it to buy a manufactured home, but not all lenders will finance manufactured homes.

In addition to no down payment, VA Loans do not require monthly mortgage insurance. Additionally, the low APRs and the lack of monthly mortgage insurance make the loan more affordable than most loans. The low-interest rates are great for veterans, but there are also other advantages.

Brought To You By: Mortgage Consultants in Greenwood Village, Colorado

Greenwood Village is a home rule municipality in Arapahoe County, Colorado. At the time of the 2020 United States Census, the city’s population was 15,691. Greenwood Village is located in the Denver–Aurora–Lakewood, Colorado Metropolitan Statistical Area, which is part of the Front Range Urban Corridor. Greenwood Ranch was the inspiration for the town’s name. It was founded in the 1860s by settlers from the East and Midwest in search of gold. By the early twentieth century, it had developed into an agricultural hamlet. The town has a total area of 5,299 acres (21.444 km2) as of the 2020 United States Census, including 7.9 acres (0.032 km2) of water. As of the 2000 census, the city had a population of 11,035 people, 3,997 households, and 3,097 families. The population density was 1,361.0 inhabitants per square mile (525.4 inhabitants per km2). There were 4,206 dwelling units at an average density of 518.7 dwelling units per square mile (200.2 dwelling units per km2).

Things To Do Near Greenwood Village

VA Loans Near Me

Arapahoe Acres, Arapahoe Rd & S Quebec St, Baker, Belcaro, Brookdale Greenwood Village, Capitol Hill, Castle Pines Village, Century Communities CO, Cherry Hills, Cherry Hills North, Cherry Knolls, College View, Country Club Historic Neighborhood, Denver Tech Center, DTC Roundtree, Golden Triangle, Goldsmith, Greenwood Pines Park, Greenwood Village, Hampden South, Harvey Park South, Holly Ridge Neighborhood

The Article VA Loans in Greenwood Village Colorado – Who’s Eligible? First Appeared ON

: https://gqcentral.co.uk

John Mu: Google Doesn’t Index Parts Of A Page Separately Unless It’s Embedded Content

John Mu: Google Doesn’t Index Parts Of A Page Separately Unless It’s Embedded Content December 2021 Google Product Reviews Update Rolling Out – What We See So Far

December 2021 Google Product Reviews Update Rolling Out – What We See So Far 60% Of SEOs Saw No Changes With The Google November Core Update

60% Of SEOs Saw No Changes With The Google November Core Update John Mu: Our Product Experts Don’t Get A Ranking Boost Or Ranking Secrets

John Mu: Our Product Experts Don’t Get A Ranking Boost Or Ranking Secrets

Screaming Frog Technical Audit

Screaming Frog Technical Audit Google Search Console Performance Audit

Google Search Console Performance Audit Google Search Console Coverage and Usability Audit

Google Search Console Coverage and Usability Audit Keyword Cannibalization Identification

Keyword Cannibalization Identification Page Quality Rater Guideline Audit

Page Quality Rater Guideline Audit Complete Site Health Guideline Report

Complete Site Health Guideline Report Action Item List for Implementation

Action Item List for Implementation Surfer SEO Report

Surfer SEO Report Titles, Tags, and Metas

Titles, Tags, and Metas TF-IDF and Semantics

TF-IDF and Semantics Co-Occurrence Tactics

Co-Occurrence Tactics Entity Recognition Signals

Entity Recognition Signals Internal Linking and Silos

Internal Linking and Silos TOC Jump Link Optimization

TOC Jump Link Optimization Organizational & FAQ JSON LD Schema

Organizational & FAQ JSON LD Schema

attorney”. The plan was to build internal links to a target page and see if the inner links made this term go up. The title of the page had “purple cow attorney” in the H1 but did not contain the emoji.

attorney”. The plan was to build internal links to a target page and see if the inner links made this term go up. The title of the page had “purple cow attorney” in the H1 but did not contain the emoji. attorney” and the term “purple cow attorney” has moved up one spot.

attorney” and the term “purple cow attorney” has moved up one spot.

![→ Click here to download leadership lessons from HubSpot founder, Dharmesh Shah [Free Guide].](https://gmbhero.com/wp-content/uploads/2021/12/4e634041-e1ce-4a85-8e65-aea12fc10b84.png)

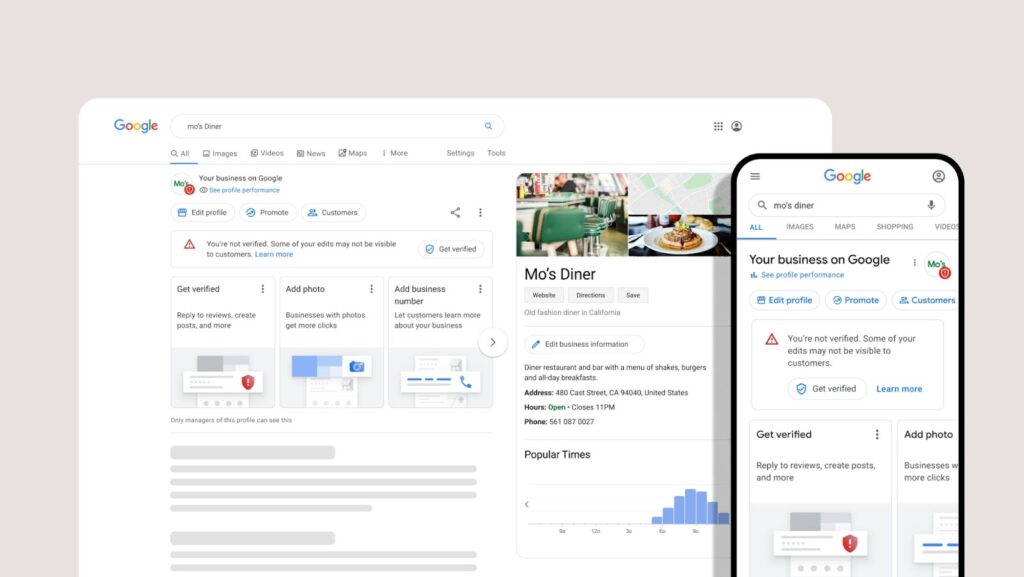

Improve Your Maps Visibility

Improve Your Maps Visibility