How to Find a Flooring Contractor in Reseda

Locating the ideal Flooring Contractor in Reseda can be challenging. Contacting nearby providers and comparing installation rates is the best place to start. If you’re searching for a reputable firm that offers a diverse selection of flooring solutions, give Networx a call. They have been in business since 1999 and specialize in hardwood flooring. They can assist you in the choosing process and provide you with a no-obligation price for your project. Locating the ideal Flooring Contractor in Reseda can be challenging.

![Flooring Contractor]()

Selecting a flooring contractor is not difficult if you have a clear vision of what you want. You can choose the one that has the greatest selection of flooring materials and styles. This way, you can discover the ideal match for your house. After deciding on the sort of flooring you like, the following step is to establish a budget. The top flooring businesses provide a wide variety of flooring alternatives, so you can be confident that your new floor will not break the bank.

If you lack experience installing floors, you might want to consider hiring a flooring contractor. They can give a free estimate and may even assist you in selecting the finest flooring material for your job. Additionally, they may assist you in selecting the appropriate hue. A skilled painter will be familiar with the room’s architectural elements and will select the appropriate color for the region. Whether you choose to paint the entire room or just a portion of it, you’ll be glad you hired the professional you did.

Find A Flooring Contractor In Reseda

Since 1999, One-Stop Kitchen & Flooring has been installing hardwood flooring in Reseda, California. Additionally, they provide additional flooring services such as laminate and luxury vinyl flooring. Networx can assist you if you want a specialist to complete a new flooring job in your Reseda home or workplace. Simply enter your project’s information, including the kind of flooring, to receive comparable estimates from nearby hardwood flooring businesses.

LA Floor Covering offers hundreds of flooring selections to residents in Reseda. Since 1999, this firm has been in the flooring industry, and their showroom is brimming with samples of the many flooring alternatives they provide. With over 500 styles to pick from, LA Floor Covering offers a diverse selection to its consumers. Additionally, they are licensed, bonded, and insured, which gives you peace of mind while making your selection. It is critical to select a contractor with a demonstrated history of offering high-quality service and installation.

Each contractor must have a valid license. In the future, those without authorization may be excluded from licensing obligations. Additionally, homeowners may ensure that their flooring contractor is adequately insured, which can protect them in the event of a tragedy. Verifying the contractor’s license is an easy job. Applicants must pass a comprehension and aptitude exam. If you’re doubtful of a flooring contractor’s qualifications, it’s a good idea to check their license status.

Flooring Contractor In Reseda

![bedroom dresser]()

Are you looking for a Reseda Flooring Contractor? Better Homes and Gardens is a fantastic resource for locating a flooring contractor. They can assist you with all aspects of flooring installation, from carpet installation to linoleum floor installation. There are several alternatives available at Better Homes and Gardens Local Services. Numerous individuals are bonded and insured, and they will ensure that you receive the highest quality service possible.

Flooring contractors come in a variety of shapes and sizes in Reseda. You have a variety of options, including hardwood, laminate, and engineered wood. Choosing the appropriate kind is determined on the sort of flooring you choose. A Reseda Flooring Contractor will ensure that the design and materials you select are used. If you’re searching for a more contemporary style, laminate flooring may be a good option. While a resilient floor will guard against wear and tear, a durable vinyl floor is a wise investment.

Best Flooring Contractor In Reseda

If you’re looking for a flooring contractor in Reseda, CA to install a hardwood floor or tile floor in your house, you have several possibilities. Networx can supply you with a list of contractors and a free quotation. Additionally, you may utilize the Networx website to obtain comparative quotes from local hardwood flooring contractors. Consider the following choices. Continue reading to learn more.

LA Floor Covering is well-known in Reseda for its high-quality workmanship and diverse variety of materials. They stock their store with hundreds of flooring samples. They also provide free estimates, which is not the case with a home improvement store. Additionally, they provide free estimates and installation. You may request a quotation and book a free estimate by contacting them. Simply inquire about their guarantee and warranty. You won’t have to worry about your flooring being ripped up or harmed.

Color selection is critical to the success of the project. When creating the space, the skilled painter produces a strategy that keeps the end goal in mind. They take into account not only the architectural characteristics of the structure but also the color of the floor and window coverings. You may choose to use a lighter shade than the current walls. However, if you’re trying for a more dramatic appearance, a dark hue may not be the best choice for you. If you’re looking for a flooring contractor in Reseda, you’ll discover that they provide a diverse range of services.

Financing Flooring Contractors

If you are currently implementing a new flooring project, you may be asking how to fund your venture. The short answer is yes. A personal loan can provide you with the finances you want, and you can frequently obtain approval for the funds within minutes. While banks and other major financial institutions are typically the greatest alternatives for larger firms, alternative funding may be the best option for smaller enterprises. A home equity loan may help you finance your flooring renovation in a matter of days and is a wonderful option if your credit score is above average.

If you have a low or no credit score, you can still qualify for flooring financing. Personal loans, on the other hand, have greater interest rates and shorter payback terms than conventional house loans. Additionally, bad credit can influence your eligibility for some types of financing, so it is prudent to thoroughly explore your alternatives. If you have a sufficient amount of positive feedback but a limited or nonexistent credit history, you may always apply for a no credit check loan. While these loans give a little amount of money, they have shorter durations than a standard loan.

If you have poor credit or no credit at all, you may be able to obtain financing for your new flooring. While you may not be able to pay the whole balance in one go, you may look into payment plans that allow you to pay over time without incurring late fees. Additionally, you may finance your new flooring with a home renovation loan. You may even apply for one if you have poor credit, which may assist you in obtaining the funds you want.

When applying for a flooring loan, take in mind the diversity of available possibilities. You may need to pick between a personal loan and a home equity line of credit, depending on the size of your project. The primary distinction between these two choices is the type of collateral required. If you own a house, you may also apply for a home equity line of credit. You’ll need to determine whether a loan is appropriate for your organization, as well as whether it’s secured or unsecured.

When determining how to finance your flooring project, keep in mind that the cost is dictated by the kind of material and the location. Installing carpet should cost between $1 and $3 per square foot, but refinishing an old hardwood floor should cost between $3 and $9 per square foot. While the expenses are comparable, it is critical to remember that the cost of a professional in a high-cost region will almost certainly be more than the cost of a homeowner in a low-cost area.

Assume you have excellent credit and wish to maximize your earnings by securing the finest financing feasible for your flooring project. You may obtain finance that is appropriate for your business and budget, and a home equity loan can be used to fund marketing and other expenditures. If you choose to finance your flooring contractor, select the one that is most advantageous to your circumstances. In this manner, you can guarantee that you obtain the finest price and can easily afford the financing you want.

A personal loan may be a good alternative depending on your credit score. While this form of financing may be difficult to secure, it will enable you to fund your flooring project without difficulty. By evaluating several financing alternatives, you can choose which one is the greatest fit for your circumstances. In this manner, you may avoid the exorbitant interest rates and headaches associated with securing the ideal finance for your project. Additionally, it will assist you in obtaining the finest bargain. Making regular payments and maintaining excellent credit is critical.

If you’re seeking a house loan for your flooring renovation, you should first determine the project’s entire cost. Then, multiply this sum by the price of the flooring material to obtain a more precise estimate. This can help you determine how much money you’ll need to borrow. There are several financing options available for your flooring project. You should be able to obtain up to four quotations within minutes if you have a pre-approved mortgage.

How to Finance a Flooring Contractor

Numerous folks are curious about how to finance a flooring contractor. While it may appear hard, you may obtain a loan from a bank or credit union in your area. Small companies can even finance their new flooring with a personal loan. These loans are frequently accepted. Additionally, you are not required to furnish collateral. While these loans are more costly than traditional bank borrowing, they will save you considerable time. A sound financial strategy helps ensure the seamless operation of your organization.

There are a variety of financing options available for your flooring contractor. To begin, you can apply for a home equity loan via your neighborhood bank. Your home equity loan will be utilized to cover the cost of supplies and labor in this situation. Additionally, you will need collateral, which will help you acquire a larger loan amount. However, you need to ensure that you select the appropriate form of loan for your flooring business and personal circumstances. It would be prudent to seek out financing options that allow you to leverage your home equity in order to obtain the greatest rate.

You should ensure that you have sufficient funds to cover the cost of your flooring contractor’s services. While there are several advantages to self-funding your business, there are also numerous drawbacks. The optimal financing strategy is one that enables you to capitalize on financial rewards. You should conduct research and choose how to fund a flooring contractor. Contractors are frequently compensated in arrears for their time and materials. If you’re considering establishing a new flooring business, consider taking out a home equity loan to maximize your investment.

Prior to discussing the final price with your flooring contractor, discuss financing possibilities. The critical point to remember is to be completely transparent about the financial choices you pick. When negotiating a price, avoid bringing up financing until after the price has been agreed upon, as this will entice the consumer to spend more money. Finally, this will assist you in developing a long-term relationship with the client. Consider a home equity line of credit or a personal loan to finance your flooring business.

Always request quotes and alternative financing options while negotiating a flooring deal. Home equity lines of credit can be used to finance your project. If you are unable to borrow money for the balance of the project, you may always negotiate a floor-to-wall arrangement. Additionally, you can finance the flooring using a home equity loan. Whether you want to finance your flooring contractor through a home equity loan or a private lender, you may discuss your financing strategy with your broker.

If you’re considering financing your flooring, you’ll want to examine the whole cost of the job. By submitting an application to the lending firm, you can apply for a flooring loan. When submitting your application, you will be required to supply information on the square footage of your property and the cost of materials. To accept your loan, a lender will want you to submit a credit check with the contractor. When you’re ready to go, financing your flooring will be easier than ever.

Numerous financing options are available. You may qualify for a home equity loan through a bank or credit union, or a personal loan from a home equity lender. While these solutions may appear challenging to get, they are a fantastic choice for the majority of individuals. You’ll be able to repay your loans over time, using the use of your home equity as collateral. When it comes to mortgages, you can select one that fits your needs.

Additionally, a flooring contractor might obtain financing from a credit union or another institution. Apart from banks and credit unions, you can apply for a loan through a local government. A great approach to accomplish this is to seek a business that provides floor installment payments. A cosigner may be quite beneficial when it comes to paying for a floor. You can even spread your payments out over time if you obtain a loan.

Handymanreseda Covers the Following Towns nearby Reseda, Los Angeles

Granada Hills, Mission Hills, Chatsworth, Sherman Oaks, Topanga, Pacoima, San Fernando, Valley Village, Pacific Palisades, West Hills.

The Article Find a Flooring Contractor Handyman in Reseda , Los Angeles First Appeared ON

: https://clubtheo.com

John Mu: Google Doesn’t Index Parts Of A Page Separately Unless It’s Embedded Content

John Mu: Google Doesn’t Index Parts Of A Page Separately Unless It’s Embedded Content December 2021 Google Product Reviews Update Rolling Out – What We See So Far

December 2021 Google Product Reviews Update Rolling Out – What We See So Far 60% Of SEOs Saw No Changes With The Google November Core Update

60% Of SEOs Saw No Changes With The Google November Core Update John Mu: Our Product Experts Don’t Get A Ranking Boost Or Ranking Secrets

John Mu: Our Product Experts Don’t Get A Ranking Boost Or Ranking Secrets

Screaming Frog Technical Audit

Screaming Frog Technical Audit Google Search Console Performance Audit

Google Search Console Performance Audit Google Search Console Coverage and Usability Audit

Google Search Console Coverage and Usability Audit Keyword Cannibalization Identification

Keyword Cannibalization Identification Page Quality Rater Guideline Audit

Page Quality Rater Guideline Audit Complete Site Health Guideline Report

Complete Site Health Guideline Report Action Item List for Implementation

Action Item List for Implementation Surfer SEO Report

Surfer SEO Report Titles, Tags, and Metas

Titles, Tags, and Metas TF-IDF and Semantics

TF-IDF and Semantics Co-Occurrence Tactics

Co-Occurrence Tactics Entity Recognition Signals

Entity Recognition Signals Internal Linking and Silos

Internal Linking and Silos TOC Jump Link Optimization

TOC Jump Link Optimization Organizational & FAQ JSON LD Schema

Organizational & FAQ JSON LD Schema

attorney”. The plan was to build internal links to a target page and see if the inner links made this term go up. The title of the page had “purple cow attorney” in the H1 but did not contain the emoji.

attorney”. The plan was to build internal links to a target page and see if the inner links made this term go up. The title of the page had “purple cow attorney” in the H1 but did not contain the emoji. attorney” and the term “purple cow attorney” has moved up one spot.

attorney” and the term “purple cow attorney” has moved up one spot.

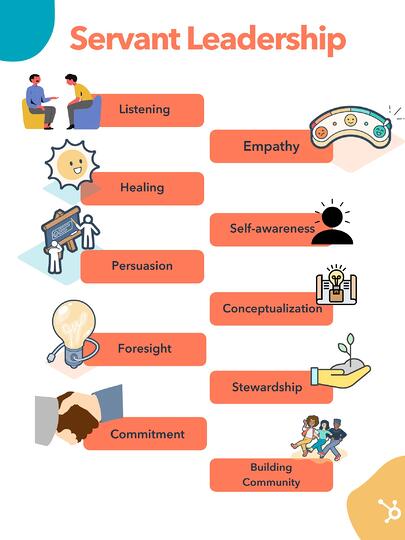

![→ Click here to download leadership lessons from HubSpot founder, Dharmesh Shah [Free Guide].](https://gmbhero.com/wp-content/uploads/2021/12/4e634041-e1ce-4a85-8e65-aea12fc10b84.png)

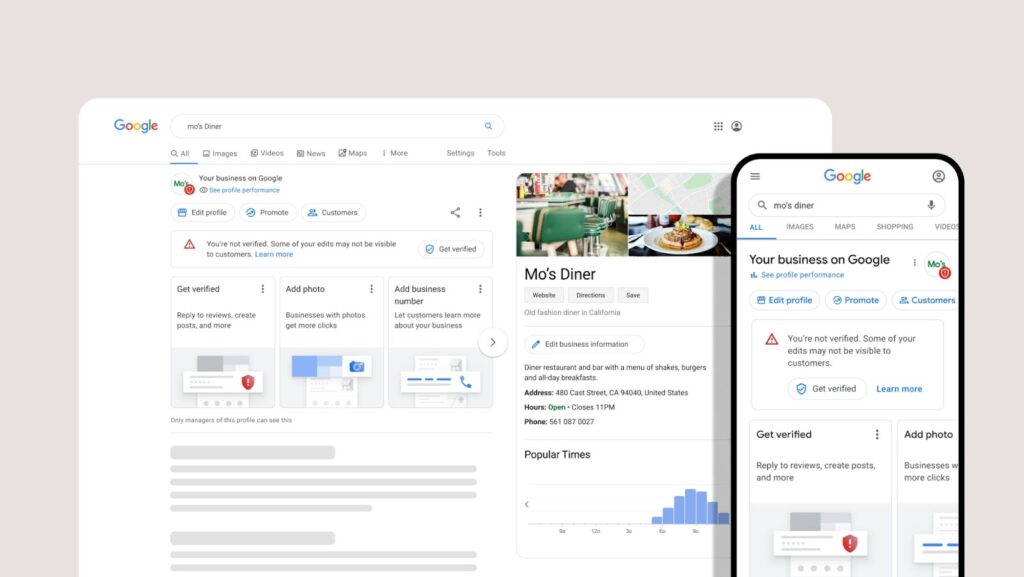

Improve Your Maps Visibility

Improve Your Maps Visibility